Rupali Bank Plcs SWIFTBIC Code Eases Global Transfers

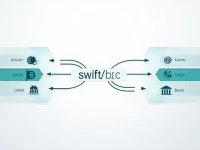

This article provides a detailed explanation of RUPALI BANK PLC.'s SWIFT/BIC code, RUPBBDDHAGC, covering its components, usage scenarios, and important considerations. It aims to assist users in accurately utilizing this code for international money transfers, preventing errors and delays, and ensuring the safe and efficient delivery of funds to the recipient. Understanding the nuances of the SWIFT code is crucial for smooth and secure cross-border transactions involving RUPALI BANK PLC.